How Custom Market Research Powers Multi-Channel Content Marketing and Sales Enablement

Most B2B companies commission a study, publish a press release and call it done. That’s like buying a Ferrari and only driving it to the grocery store.

After years of helping companies develop and deploy research initiatives, I’ve noticed a pattern among the most successful ones. They approach market research differently than their competitors. While most companies commission a study and file it away after announcing it, the category leaders extract value across their entire organization.

We’ve been seeing more and more companies recognize that the legacy “one study, one report” model doesn’t deliver the ROI they need. Now it’s undeniable.

Companies winning market share treat research data like a Swiss Army knife: one tool with multiple GTM applications. When we helped a DevOps company uncover that 93.6% of IT leaders reported remote work extended incident resolution times, that statistic became the opening line of sales presentations, the hook for webinar content, the validation for product roadmap decisions and the centerpiece of a six-month thought leadership campaign, all after we executed the initial successful PR push.

How Data-Driven Content Marketing Fuels B2B Sales

Gone are the days when marketing created content and sales used completely different materials. Today’s buyers expect consistent messaging across every touchpoint. Research data provides that golden thread connecting your PR efforts to your sales presentations to your customer success stories.

Buyers don’t just want features and benefits anymore. They want proof that other companies like theirs face similar challenges. Original research provides that social proof in spades. When prospects see statistics that reflect their own experiences, they immediately recognize themselves in those findings.

The most effective companies understand six fundamental truths about market research:

- Research data should never live in a marketing silo.

- Sales needs it for credibility.

- Customer success needs it for renewal conversations.

- Product needs it for roadmap validation.

- Finance needs it for market sizing.

- One research initiative can serve them all.

Smart companies extract maximum value by deploying research across every revenue function. Your reps walk into meetings armed with current, microtargeted industry intelligence instead of generic pitch decks. They lead with market data that helps prospects diagnose their own problems before discussing solutions.

Every technology company fights for share of voice in crowded channels. Original research cuts through the noise, gated reports qualify prospects, webinars draw industry experts and prospects, and executive summaries of data-backed proof points get forwarded to decision-makers.

When CFO Magazine featured our client’s finding that “79% of Companies Face Challenges When Purchasing New Tech,” it wasn’t just media coverage. Those citations became sales conversation starters for many months.

Another research initiative for a different client uncovered hidden barriers in application modernization journeys and validated market demand for emerging features. The research data became a foundation for ongoing content and sales efforts, with the investment paying for itself within 90 days through qualified leads from the gated report.

Product announcements backed by market data also land differently than those backed by nothing. When you can say “92.3% of businesses struggle with X, which is why we built Y,” you’re not just explaining features, you’re validating market needs.

For example, custom research we executed for an agtech AI company uncovered that 90.2% of agribusinesses experience climate change effects on yield, 92.3% struggle to operationalize existing farm data and that 3 out of 4 say AI will help them accomplish complicated data analysis at scale. These statistics became the foundation for everything: sales presentations, investor pitches, product positioning, PR campaigns and conference keynotes. Three key data points, mounds of highly targeted cross-tab data to cater to specific prospect personas, 18 months of content fuel.

The Formula for Gaining Competitive Advantage and Increasing ROI with Custom Research

Your competitors can quote third-party industry reports. They can’t quote your custom research. When you’re the source of the data, you’re the authority. When journalists cite your research, they position you as the expert. When sales prospects see your statistics quoted in industry publications, you’ve already won credibility before the first sales call.

The companies extracting 10x value from their research investments follow a simple formula. They:

– Design research that validates their market thesis

– Don’t just ask random questions, but instead ask questions that prove their point of view

– Create modular content from Day One by extracting quotable statistics, compelling visualizations and shareable insights that work across channels

– Arm every revenue function with data so sales gets talking points and presentation slides, marketing gets campaign themes and content, product gets validation and PR gets media-worthy story angles

– Measure what matters by tracking pipeline influence, not just media mentions

Research Should Drive Revenue, Not Just Awareness

Business moves fast. Companies that can pivot quickly across multiple communication fronts win. Those stuck thinking research just equals reports lose.

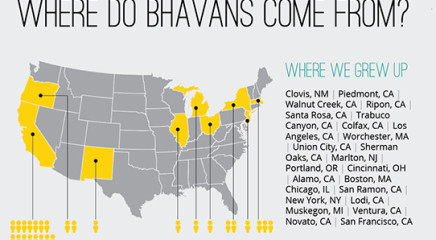

At Bhava, we’ve seen this pattern repeat across AI startups, SaaS and DevOps companies, public companies in enterprise tech and other emerging sectors. The companies that treat research as their content Swiss Army knife consistently outperform those that don’t.

One well-executed research initiative can fuel 12 months of go-to-market activities. The question isn’t whether you can afford to invest in original research. The question is whether you can afford to keep treating it like a one-hit wonder.